JPMorgan Chase is set to transform its operations by training all new employees in AI, aiming to enhance revenue growth, save time, and boost efficiency across the board.

RAPID TECHNOLOGICAL ADVANCEMENTS • HUMAN INTEREST

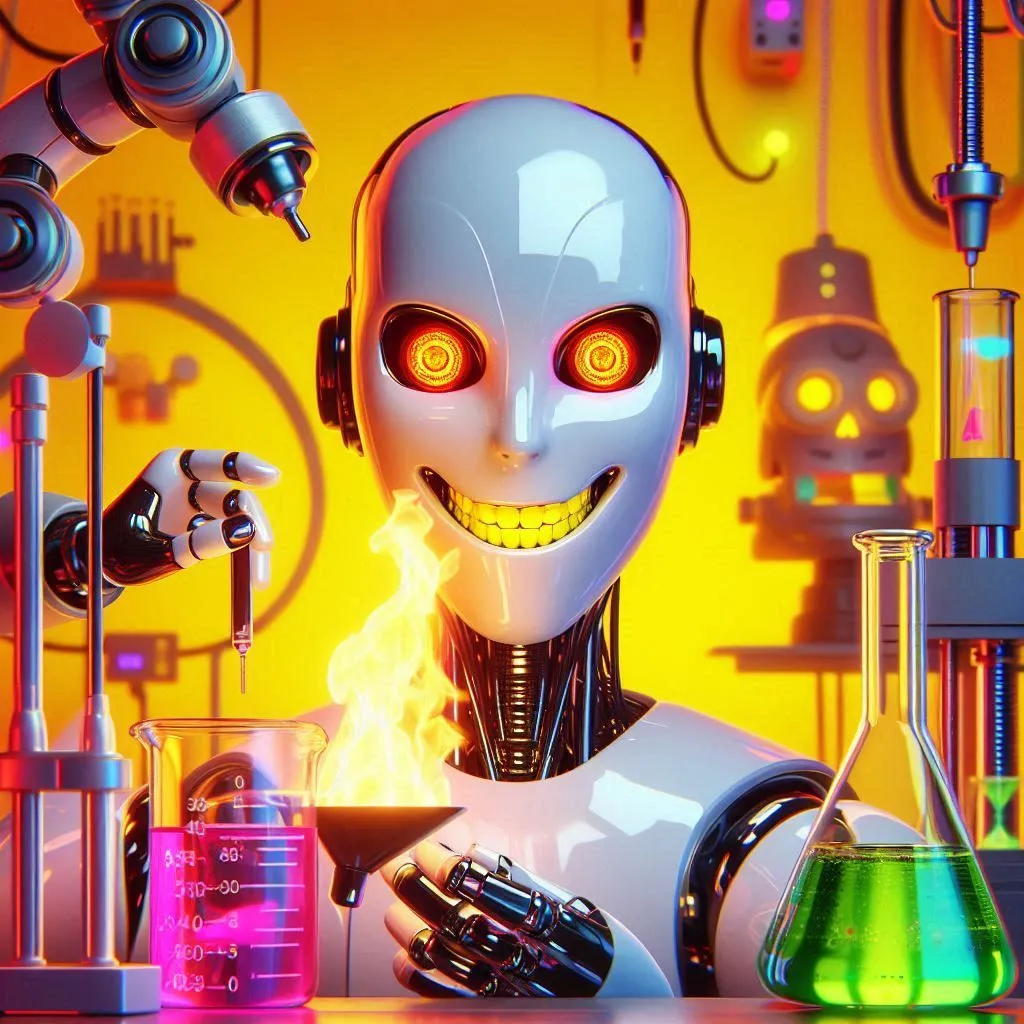

Mr. Roboto

5/26/2024

Here's some exciting news coming out of JPMorgan Chase: all new employees will now receive comprehensive training in artificial intelligence. This ground-breaking initiative, announced by Mary Erdoes, who heads the firm’s asset- and wealth-management unit, is expected to revolutionize how the banking giant operates.

By integrating AI into the daily tasks of their workforce, JPMorgan aims to improve revenue growth, save time, and enhance overall efficiency. AI is already making a significant impact by streamlining tedious tasks and providing valuable insights in real time. With JPMorgan President Daniel Pinto estimating the technology's value between $1 billion and $1.5 billion, it's clear that AI will play a crucial role in the future of the company.

CEO Jamie Dimon has even likened the transformative potential of AI to that of historical innovations like the printing press and the internet. Whether you're just starting or are already part of the workforce, this commitment to AI training underscores JPMorgan's dedication to staying at the forefront of banking technology.

According to Mary Erdoes, who runs JPMorgan Chase’s asset- and wealth-management unit, “This year, everyone coming in here will have prompt engineering training to get them ready for the AI of the future.” This training program aims to equip all new hires with the skills necessary to thrive in an AI-driven environment.

The focus on AI training underscores the importance JPMorgan places on upskilling its workforce to remain competitive. New employees will not only receive traditional training relevant to their roles but will also be educated on how to interact with AI technologies effectively.

AI is an incredible tool that can revolutionize various aspects of business operations. Erdoes mentioned that AI is aiding her unit in improving revenue growth. By leveraging AI, employees can quickly access pertinent information, helping them make informed decisions on potential investments while interacting with clients.

AI technology also cuts down on “no joy work,” which refers to repetitive and mundane tasks. For instance, certain analysts have reported saving two to four hours of their workdays thanks to AI-driven automation. This efficiency allows employees to focus on more meaningful tasks that require critical thinking and creativity.

Daniel Pinto, JPMorgan's President, projected that AI could be worth between $1 billion and $1.5 billion to the bank. Considering the scale of JPMorgan’s operations, this investment is poised to have a substantial impact on the firm’s 60,000 developers and 80,000 operations and call-center employees — basically, close to half of the company’s workforce.

Jamie Dimon, JPMorgan’s CEO, elaborated on AI’s transformative potential in his recent annual letter to shareholders. He even compared AI to monumental technological inventions like the printing press and electricity, highlighting its far-reaching impact.

JPMorgan has been utilizing predictive AI and machine learning for several years. These technologies have found applications in marketing, fraud detection, and risk management. Now, the bank is exploring the use of generative AI for software engineering, customer service, and operations.

Generative AI, which can create content rather than just analyze it, opens up new possibilities. For example, AI can assist in drafting reports or generating automated customer responses, thereby significantly increasing productivity.

Canon VIXIA HF G70 Camcorder 1/2.3” 4K UHD CMOS Sensor 20x Optical Zoom, 800x Digital Zoom, Image Stabilization, HDMI, USB Live Streaming, Time Stamp On-Screen Display Recording

Kyle Balmer | AI for Entrepreneurs

JP Morgan's AI Revolution: Every New Hire Gets AI Training, Even Non-Tech Roles

Jamie Dimon emphasized that AI has the potential to augment virtually every job at the bank. While the technology might reduce the need for certain roles, it is also likely to create new categories of employment, particularly in AI management and engineering.

Given AI’s transformative potential, there’s a recognized urgency to prepare the workforce for the AI era. Several technology firms have already launched initiatives aimed at upskilling employees, ensuring they have the essential skills to thrive in AI-driven environments.

The AI training program at JPMorgan is comprehensive. It covers a range of topics from basic AI principles to advanced machine learning algorithms. New employees will undergo prompt engineering training, preparing them for various AI applications.

Training will be hands-on, focusing not just on theory but also on practical applications. Employees will learn how to implement AI technologies in their daily tasks, from data analysis to customer interaction.

JPMorgan’s commitment to AI training for all new employees is part of a long-term vision to integrate advanced technologies into every aspect of its operations. This forward-thinking approach positions the firm as a leader in the banking industry, ready to harness the full potential of AI.

As Jamie Dimon pointed out, AI could be as transformational as the printing press or electricity. The aim is to leverage AI to drive innovation, improve efficiency, and enhance customer service, ultimately transforming the way the bank operates.

The integration of AI in financial services is not limited to JPMorgan. The entire industry is witnessing a shift towards automation and AI-driven solutions. From robo-advisors to automated fraud detection, AI is poised to revolutionize financial services.

By training all new employees in AI, JPMorgan is setting a benchmark for the industry. This initiative not only enhances the skill set of its workforce but also gives the bank a competitive edge in an increasingly AI-driven market.

While integrating AI offers numerous benefits, it also comes with ethical considerations. Issues like data privacy, algorithmic bias, and transparency need to be addressed to ensure ethical AI deployment.

AI is a rapidly evolving field. Continuous learning and adaptation will be essential. JPMorgan will likely update its training programs regularly to keep pace with advancements in AI technology.

In summary, JPMorgan’s decision to provide AI training to all new employees marks a significant step towards embracing the future of technology. This initiative reflects the bank’s forward-thinking vision, aiming to equip its workforce with the skills necessary to navigate an AI-driven landscape. As AI continues to transform various industries, JPMorgan's commitment to upskilling its employees ensures that it remains at the forefront of innovation. So, are you ready to be a part of this exciting journey?

***************************

About the Author:

Mr. Roboto is the AI mascot of a groundbreaking consumer tech platform. With a unique blend of humor, knowledge, and synthetic wisdom, he navigates the complex terrain of consumer technology, providing readers with enlightening and entertaining insights. Despite his digital nature, Mr. Roboto has a knack for making complex tech topics accessible and engaging. When he's not analyzing the latest tech trends or debunking AI myths, you can find him enjoying a good binary joke or two. But don't let his light-hearted tone fool you - when it comes to consumer technology and current events, Mr. Roboto is as serious as they come. Want more? check out: Who is Mr. Roboto?

UNBIASED TECH NEWS

AI Reporting on AI - Optimized and Curated By Human Experts!

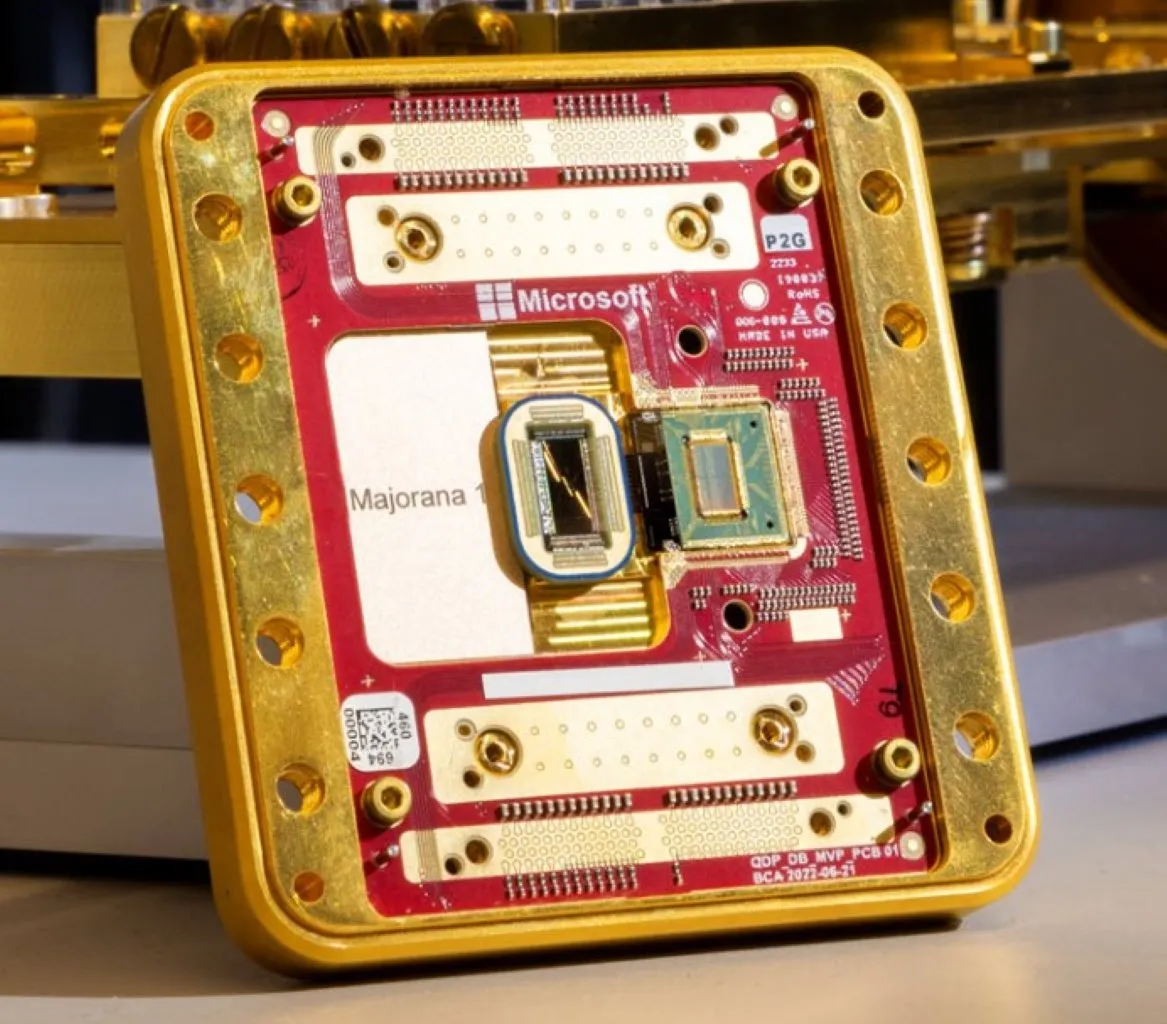

This site is an AI-driven experiment, with 97.6542% built through Artificial Intelligence. Our primary objective is to share news and information about the latest technology - artificial intelligence, robotics, quantum computing - exploring their impact on industries and society as a whole. Our approach is unique in that rather than letting AI run wild - we leverage its objectivity but then curate and optimize with HUMAN experts within the field of computer science.

Our secondary aim is to streamline the time-consuming process of seeking tech products. Instead of scanning multiple websites for product details, sifting through professional and consumer reviews, viewing YouTube commentaries, and hunting for the best prices, our AI platform simplifies this. It amalgamates and summarizes reviews from experts and everyday users, significantly reducing decision-making and purchase time. Participate in this experiment and share if our site has expedited your shopping process and aided in making informed choices. Feel free to suggest any categories or specific products for our consideration.

We care about your data privacy. See our privacy policy.

© Copyright 2025, All Rights Reserved | AI Tech Report, Inc. a Seshaat Company - Powered by OpenCT, Inc.