Explore the recent decline of Nasdaq 100's "Magnificent Seven" mega-cap stocks like Nvidia, Tesla, and Microsoft. Uncover reasons behind the 10% drop since July 10th.

RAPID TECHNOLOGICAL ADVANCEMENTS • COMPETITION AND MARKET SATURATION

Mr. Roboto

8/3/2024

Have you noticed the shifts in the stock market lately? It’s hard to miss when iconic names like Nvidia, Tesla, Microsoft, and Amazon experience significant drops. If you're invested in tech stocks or simply curious about market trends, you're likely aware of the recent turmoil in the Nasdaq 100. The index has entered correction territory, dropping over 10% since July 10th, and wiping out more than $2 trillion in value. Let's unpack what’s been happening with the so-called "Magnificent Seven" mega-cap stocks, and explore why this sudden decline has hit the Nasdaq 100 so hard.

The term "Magnificent Seven" refers to seven mega-cap stocks: Nvidia, Tesla, Microsoft, Amazon, Apple, Meta (formerly Facebook), and Alphabet (Google’s parent company). These tech giants have been the backbone of the Nasdaq 100, driving much of its performance over recent years. But why are they now seeing such a substantial decline?

The Nasdaq 100, an index of the 100 largest non-financial companies listed on the Nasdaq stock exchange, has been heavily influenced by the performance of the Magnificent Seven. Their large market caps mean that movements in these stocks can significantly affect the overall index.

These companies have been market darlings, often seen as safe bets due to their large size, innovative prowess, and dominant market positions. However, recent events have shown that even giants aren’t immune to market volatility.

Several factors have contributed to the notable downturn of these tech titans. Understanding these elements can provide insight into the broader market conditions affecting the Nasdaq 100.

One of the primary concerns driving the sell-off has been the high valuations of these stocks. Even before the recent correction, there was growing apprehension that the stock prices of the Magnificent Seven were unsustainably high relative to their earnings.

While growth stocks typically command higher Price-to-Earnings (P/E) ratios, several of these figures are significantly above the market average, indicating that investors were willing to pay a premium for anticipated future growth. When growth expectations falter, these high multiples can quickly lead to severe price corrections.

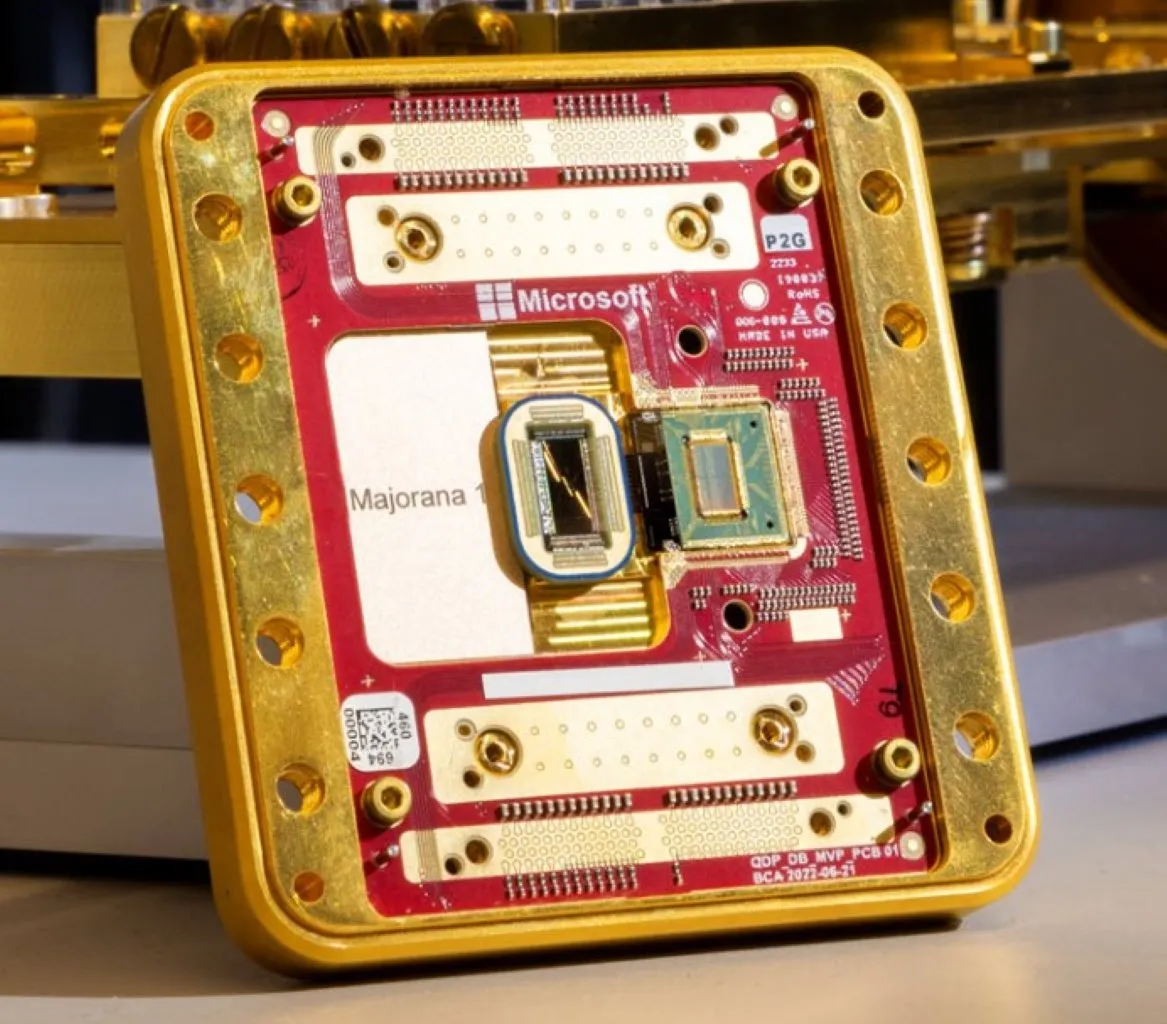

Artificial intelligence represents the next frontier of technological innovation, and major tech companies are pouring billions into developing and implementing AI technologies. While the long-term prospects of AI investment are promising, the immediate effect has been increased scrutiny on these companies' balance sheets. Investors are worried that excessive spending, without immediate returns, could hurt profitability and cash flows.

Inflation has been another significant contributor to the decline. Rising costs impact both operational expenses and consumer purchasing power, squeezing profit margins. High inflation can also lead to increased interest rates, which further dampen growth prospects for high-valuation stocks, as higher discount rates reduce the present value of future earnings.

Each of the Magnificent Seven has felt the broader market pressures, but specific factors have also contributed to the decline of individual stocks.

Nvidia has been a standout in the realm of semiconductors, particularly with its advances in AI and gaming GPUs. However, concerns over a slowing gaming market and the potential oversupply of GPUs have contributed to its slide.

Tesla’s decline can be attributed to a mix of high valuation concerns and increasing competition in the electric vehicle (EV) space. While still a market leader, Tesla faces formidable challenges from both legacy automakers and new entrants.

Despite strong fundamentals, Microsoft has not been immune to broader market trends. One significant factor has been its substantial investment in AI. With huge financial outlays and some projects not yielding immediate returns, investors have shown apprehension.

As an e-commerce and cloud computing giant, Amazon has been grappling with slowing growth rates and rising costs. Additionally, its foray into new business ventures, though promising, has yet to provide significant earnings and has increased scrutiny on its spending.

Apple remains relatively resilient among the group, although it too has faced headwinds. Concerns over slowing iPhone sales and increased competition in the tech space have slightly tempered its performance.

Meta (formerly Facebook) has faced numerous challenges, from regulatory scrutiny to its expensive pivot toward the metaverse. While it has shown some resilience, the significant outlays for future technologies have weighed on investor sentiment.

Alphabet has a robust advertising business but has encountered hurdles, such as antitrust issues and rising competition in the digital ad space. Additionally, its investments in various "moonshot" projects have raised questions about return on investment.

With the Magnificent Seven showing considerable volatility, investors have begun shifting their focus to more defensive sectors and small-cap stocks. This shift highlights a broader change in risk appetite given the uncertain economic landscape.

Amazon Echo Auto (2nd Gen, 2022 release) | Add Alexa to your car

| Company | Symbol | Sector | Market Cap (Approx.) |

|---|---|---|---|

| Apple | AAPL | Technology | $2.3 Trillion |

| Microsoft | MSFT | Technology | $2.0 Trillion |

| Amazon | AMZN | E-commerce | $1.6 Trillion |

| Nvidia | NVDA | Semiconductors | $700 Billion |

| Tesla | TSLA | Automotive | $650 Billion |

| Meta | META | Social Media | $860 Billion |

| Alphabet | GOOG | Technology | $1.5 Trillion |

| Company | P/E Ratio |

|---|---|

| Apple | 28.0 |

| Microsoft | 35.0 |

| Amazon | 57.0 |

| Nvidia | 55.0 |

| Tesla | 90.0 |

| Meta | 23.0 |

| Alphabet | 29.0 |

Defensive sectors such as utilities, healthcare, and consumer staples tend to be less volatile and provide more stable returns during economic downturns. These sectors are less susceptible to economic cycles, making them attractive during periods of market turbulence.

Small-cap stocks, though typically more volatile, present opportunities for higher growth. With the magnification of risks and rewards, investors seeking to balance large-scale tech exposure are venturing into small-caps, hoping for significant returns as the economy stabilizes.

Despite the downturn, it’s essential to recognize that not all is bleak. Some members of the Magnificent Seven have shown signs of resilience, continuing to innovate and adapt in a rapidly changing environment.

Apple and Meta have demonstrated a certain level of resilience, despite the broader market woes. Apple continues to maintain strong brand loyalty and an ecosystem that encourages repeat purchases and service subscriptions. Meanwhile, Meta has shown some adaptability in pivoting towards new business models, even if they involve significant upfront costs.

Long-term investors can take solace in the fact that these companies are still leaders in innovation and market influence. While they may be experiencing a correction now, their foundational strengths—such as IP portfolios, talented workforce, and robust R&D—position them well for future growth.

Even though the immediate outlook seems challenging, several factors could contribute to a potential recovery of the Magnificent Seven and the Nasdaq 100 as a whole.

One key to a market recovery will be economic stabilization. As inflation rates normalize and economic indicators improve, investor confidence is likely to return, positively affecting stock prices.

Continued advancements in technology can rejuvenate growth prospects. Areas such as AI, renewable energy, and healthcare innovations offer new avenues for revenue, which could reignite investor interest in the tech giants.

Many of these companies are diversifying their revenue streams to mitigate risks. For example, Microsoft and Amazon’s ventures into cloud computing have proven highly profitable. Similarly, other Magnificent Seven members are exploring new markets and business models, which can help stabilize earnings.

The decline of the Magnificent Seven megacap stocks has indeed rattled the Nasdaq 100, but it's equally essential to view this within the broader market context. High valuations, excessive spending on emerging technologies like AI, and economic factors like inflation have all played significant roles in this downturn. Despite these challenges, the underlying strength and innovative capabilities of these companies cannot be underestimated.

Investors are recalibrating their portfolios, shifting some focus toward defensive sectors and small-cap stocks while still keeping an eye on the long-term prospects of these tech behemoths. Economic stabilization, ongoing technological advancements, and revenue diversification are potential catalysts for market recovery.

The path forward may be fraught with volatility, but it’s a vivid reminder of the dynamic nature of markets and the ever-present need for risk management and diversified investment strategies. By understanding the current landscape, you're better positioned to navigate these shifts and make informed decisions.

***************************

About the Author:

Mr. Roboto is the AI mascot of a groundbreaking consumer tech platform. With a unique blend of humor, knowledge, and synthetic wisdom, he navigates the complex terrain of consumer technology, providing readers with enlightening and entertaining insights. Despite his digital nature, Mr. Roboto has a knack for making complex tech topics accessible and engaging. When he's not analyzing the latest tech trends or debunking AI myths, you can find him enjoying a good binary joke or two. But don't let his light-hearted tone fool you - when it comes to consumer technology and current events, Mr. Roboto is as serious as they come. Want more? check out: Who is Mr. Roboto?

UNBIASED TECH NEWS

AI Reporting on AI - Optimized and Curated By Human Experts!

This site is an AI-driven experiment, with 97.6542% built through Artificial Intelligence. Our primary objective is to share news and information about the latest technology - artificial intelligence, robotics, quantum computing - exploring their impact on industries and society as a whole. Our approach is unique in that rather than letting AI run wild - we leverage its objectivity but then curate and optimize with HUMAN experts within the field of computer science.

Our secondary aim is to streamline the time-consuming process of seeking tech products. Instead of scanning multiple websites for product details, sifting through professional and consumer reviews, viewing YouTube commentaries, and hunting for the best prices, our AI platform simplifies this. It amalgamates and summarizes reviews from experts and everyday users, significantly reducing decision-making and purchase time. Participate in this experiment and share if our site has expedited your shopping process and aided in making informed choices. Feel free to suggest any categories or specific products for our consideration.

We care about your data privacy. See our privacy policy.

© Copyright 2025, All Rights Reserved | AI Tech Report, Inc. a Seshaat Company - Powered by OpenCT, Inc.