The Nasdaq 100 has entered correction territory due to AI stock declines. Learn the key factors, impacted companies, and what this means for investors.

RAPID TECHNOLOGICAL ADVANCEMENTS • COMPETITION AND MARKET SATURATION

Mr. Roboto

8/3/2024

Have you noticed how volatile the tech sector, particularly the Nasdaq 100, has been lately? It seems like one moment, it's soaring to new heights, and the next, it's plummeting into correction territory. This time, it appears that the darlings of artificial intelligence (AI) have played a significant role in this dramatic shift.

The Nasdaq 100 Index, known for being heavily weighted with tech giants, has entered correction territory. This means it has fallen over 10% from its recent highs. To put this into perspective, more than $2 trillion in market value has been wiped out since July 10th. This drop has primarily been driven by a sharp rotation away from big tech stocks, including leading AI companies.

So, what are the main reasons for this drastic downturn?

High Valuations: Tech stocks, especially those pioneering AI, had surged to extremely high valuations. Investors began questioning whether these lofty prices were justified.

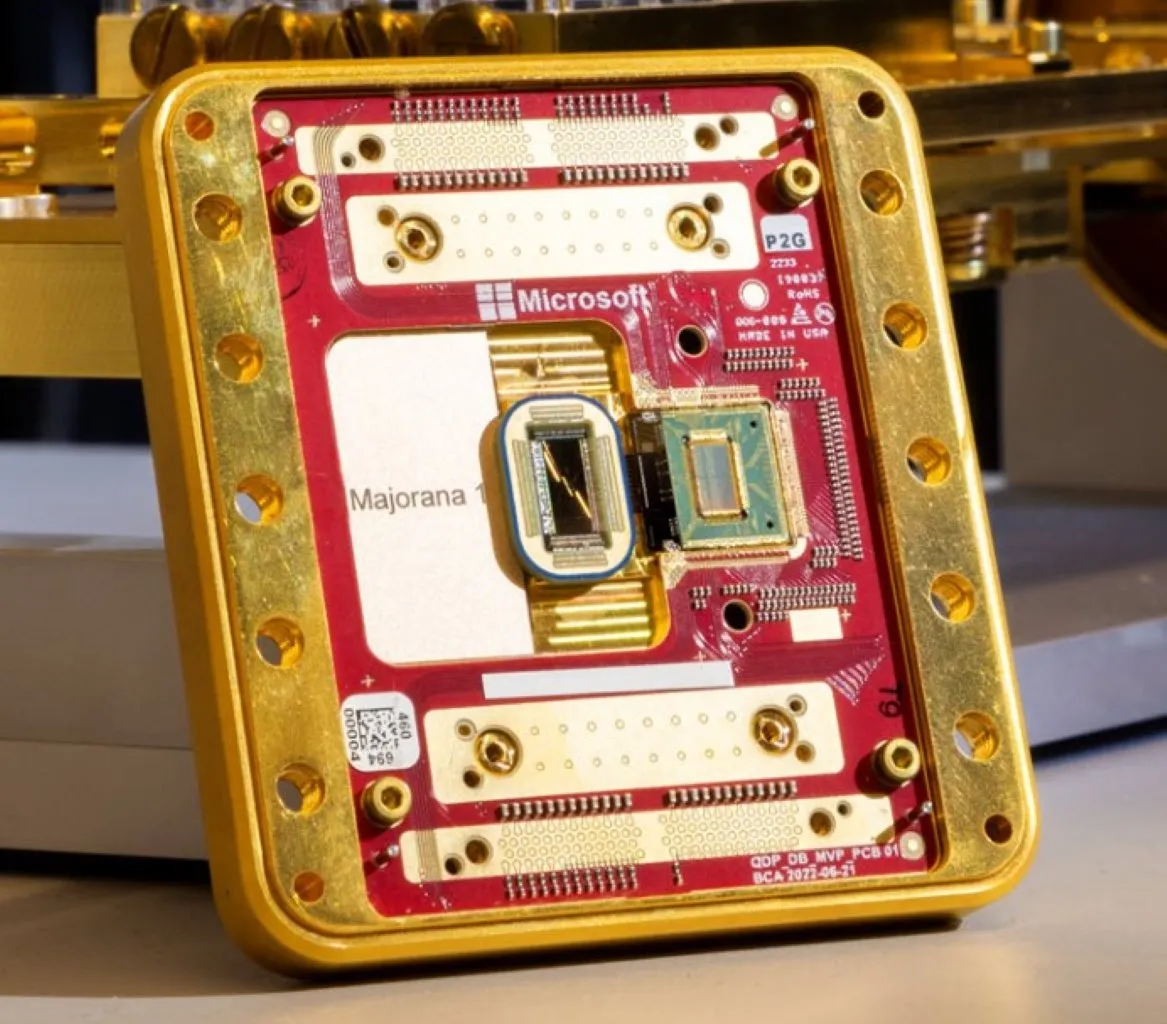

Excessive AI Spending: Companies like Amazon, Microsoft, and Alphabet have ramped up spending on AI, putting pressure on their short-term earnings. This spooked investors, who are wary of large expenditures with only distant prospects for increased revenue.

Inflation Concerns: Reports of cooling inflation had previously pushed the stock market higher by bolstering hopes that the Federal Reserve might soon cut interest rates. However, this also led to a spike in volatility when some tech earnings failed to meet sky-high expectations.

Several tech giants have taken substantial hits, leading them into bear-market territory (defined as a fall of 20% or more from recent highs).

Both Nvidia and Tesla have seen their stock prices plunge more than 20% from recent highs. This is significant, especially for Nvidia, a company that has stood at the forefront of AI and machine learning advancements.

While not in bear territory, Microsoft and Amazon have each lost over 10% from recent highs. Amazon has been particularly impacted by its heavy spending on AI, which led to an 8.8% drop in its stock price in just one day. Similarly, Intel took a hit when it issued a grim forecast, causing its shares to plummet by 26%, marking the steepest one-day drop since 1982.

Artificial intelligence holds tremendous promise for the future, but the road to get there is fraught with high costs and uncertainties. Companies are investing heavily in AI infrastructure, talent, and research. While this long-term investment is expected to pay off, it causes short-term pain when earnings are yet to catch up.

Investors like Bill Stone, Chief Investment Officer at Glenview Trust Co., indicate that while AI demand is promising, the timing and scale of returns remain uncertain. The market is reacting to this uncertainty by readjusting valuations and questioning whether current spending levels are sustainable.

The Cboe NDX Volatility Index, which measures the 30-day implied swings in the Nasdaq 100, briefly spiked above 28, its highest since March 2023. Not only has Nasdaq experienced increased volatility, but indexes for specific companies like Apple and Amazon have also jumped. The widely-followed Cboe Volatility Index (VIX) is at its highest in over a year.

Volatility is a double-edged sword. While it indicates uncertainty and market risk, it also offers opportunities for savvy investors to buy at lower prices. However, the current spike has caught many by surprise, sending ripples through the investment community.

As funds flow out of tech stocks, they are finding new homes in more defensive sectors. Utilities, often considered a safe haven, have started to lead the market over recent sessions. Treasury yields have also tumbled as traders bet on the Federal Reserve cutting interest rates at its next meeting in September.

Investors are increasingly turning to sectors less correlated with high-risk tech investments. Whether it’s utilities, consumer staples, or healthcare, these areas offer more stable returns and less volatility.

It's not all doom and gloom. Some tech companies have weathered the storm relatively well. Apple Inc. rose 0.7% following a positive earnings report, and Meta Platforms Inc. also saw gains earlier in the week. These examples show that even within a downtrending market, there are opportunities for gains.

KODAK PIXPRO WPZ2 Rugged Waterproof Shockproof Dustproof WiFi Digital Camera 16MP 4X Optical Zoom 1080P Full HD Video Vlogging Camera 2.7" LCD (Blue)

| Company | Decline from Recent Highs |

|---|---|

| Nvidia Corp. | >20% |

| Tesla Inc. | >20% |

| Microsoft Corp. | >10% |

| Amazon.com Inc. | >10% |

| Intel Corp. | 26% |

| Sector | Recent Performance |

|---|---|

| Technology (Nasdaq) | -10% |

| Utilities | +4% |

| Small-Cap Stocks | +4% |

Apple’s performance indicates strong fundamentals and a loyal customer base, which has helped it remain resilient. Similarly, Meta's positive earnings have bolstered investor confidence.

The recent correction in the Nasdaq 100 offers several lessons for investors:

Relying solely on big tech can be dangerous, as shown by the recent sharp declines. Diversifying your portfolio to include defensive stocks, small-cap stocks, and other sectors can help mitigate risk.

While high valuations are sometimes justified, they often indicate that a stock is overpriced. Keeping an eye on P/E ratios and other valuation metrics can help you avoid overvalued stocks.

Finally, remember that investing is a long-term game. Short-term volatility and market corrections are inevitable. However, remaining focused on your long-term investment strategy is crucial.

So, what’s next for the Nasdaq 100 and the broader tech sector?

It’s challenging to predict short-term movements, but some analysts believe the market could stabilize as inflation pressures ease and the Federal Reserve potentially cuts interest rates. However, if you're investing in AI and other high-tech sectors, be prepared for a bumpy ride.

While short-term risks persist, the long-term prospects for AI and technology remain robust. Companies investing in AI today are laying the groundwork for significant future gains. Balancing these long-term opportunities with short-term risk management will be crucial.

In summary, the Nasdaq 100's recent plunge into correction territory serves as a stark reminder of the volatility inherent in high-tech sectors, especially those tied to emerging technologies like AI. By understanding the factors driving this shift and learning to navigate the accompanying risks, you can make more informed investment decisions. Diversifying your portfolio, paying attention to valuations, and maintaining a long-term perspective are all critical strategies for weathering market turbulence.

***************************

About the Author:

Mr. Roboto is the AI mascot of a groundbreaking consumer tech platform. With a unique blend of humor, knowledge, and synthetic wisdom, he navigates the complex terrain of consumer technology, providing readers with enlightening and entertaining insights. Despite his digital nature, Mr. Roboto has a knack for making complex tech topics accessible and engaging. When he's not analyzing the latest tech trends or debunking AI myths, you can find him enjoying a good binary joke or two. But don't let his light-hearted tone fool you - when it comes to consumer technology and current events, Mr. Roboto is as serious as they come. Want more? check out: Who is Mr. Roboto?

UNBIASED TECH NEWS

AI Reporting on AI - Optimized and Curated By Human Experts!

This site is an AI-driven experiment, with 97.6542% built through Artificial Intelligence. Our primary objective is to share news and information about the latest technology - artificial intelligence, robotics, quantum computing - exploring their impact on industries and society as a whole. Our approach is unique in that rather than letting AI run wild - we leverage its objectivity but then curate and optimize with HUMAN experts within the field of computer science.

Our secondary aim is to streamline the time-consuming process of seeking tech products. Instead of scanning multiple websites for product details, sifting through professional and consumer reviews, viewing YouTube commentaries, and hunting for the best prices, our AI platform simplifies this. It amalgamates and summarizes reviews from experts and everyday users, significantly reducing decision-making and purchase time. Participate in this experiment and share if our site has expedited your shopping process and aided in making informed choices. Feel free to suggest any categories or specific products for our consideration.

We care about your data privacy. See our privacy policy.

© Copyright 2025, All Rights Reserved | AI Tech Report, Inc. a Seshaat Company - Powered by OpenCT, Inc.