Explore the causes and impacts of the financial crash dubbed 'new Black Monday' on August 6, 2024, as global markets tumbled and rebounded. Discover key insights.

CHANGING CONSUMER BEHAVIOR AND LIFESTYLE SHIFTS • COMPETITION AND MARKET SATURATION • COST AND AFFORDABILITY

Mr. Roboto

8/12/2024

On August 6, 2024, the financial world was shaken as the S&P 500 and NASDAQ opened with substantial losses, triggering significant declines in global markets. From the Nikkei 225 plummeting over 12% to Taiwan's main stock index facing its worst day in history, the week saw trillions of dollars evaporate, leading many to dub the event the "New Black Monday."

As quickly as the markets tumbled, they rebounded nearly the next day, recovering much of the initial losses. Analysts point fingers at Japan’s long-term low-interest rates, the Federal Reserve, and Wall Street traders for the crash, highlighting the intricate interplay of economic policies and speculative trading. This article explores the root causes, immediate fallout, and potential future of financial markets in the wake of such volatile movements.

On August 6, 2024, the financial world experienced significant turbulence as the S&P 500 and NASDAQ opened sharply lower, initiating what many now refer to as the "New Black Monday." The S&P 500 was down 3.5% at opening, with the NASDAQ plummeting 4%. This abrupt downturn wasn't confined to American markets alone; global markets fell dramatically. Over the course of the week, trillions of dollars in market value were wiped out globally.

The market calamity extended beyond U.S. borders, wreaking havoc in Asia and Europe. The Nikkei 225—a major Japanese stock index—took a severe hit, falling over 12%. Simultaneously, Taiwan's main stock index experienced its worst day in recorded history. Investors worldwide scrambled to adjust their portfolios, triggering enormous sell-offs and contributing to the market free fall.

Historically, market crashes of this magnitude bring to mind previous financial catastrophes such as the original Black Monday in 1987 and the 2008 financial crisis. While each crisis bears unique traits, the sudden, severe plunge reminiscent of past market collapses highlights the volatility and interconnectedness of modern financial markets.

When the trading began on that fateful Monday, the S&P 500 and NASDAQ suffered significant immediate declines of 3.5% and 4%, respectively. These indices are barometers of economic health, and their sharp drop signified deep investor unease. The sell-off organically expanded from these benchmarks, affecting indices across various sectors.

The panic was not isolated to the United States. European stock exchanges reported significant declines, echoing the fears prevalent in American markets. European indices like the DAX and FTSE took a beating, while Asian markets plummeted. The global reaction was fear-driven, exacerbating the sell-off and feeding the cycle of decline.

Particularly notable were the declines in Asian markets. The Nikkei 225 dropped over 12%, and Taiwan's main stock index recorded its worst day ever. These declines underscored the global reach of the catastrophe, significantly affecting economies far from Wall Street.

Miraculously, a day after this significant crash, the markets began to rally. By the end of that next trading day, most of the initial losses were nearly recovered. This rapid rebound was unexpected and added a layer of complexity to understanding market behaviors during crises.

A variety of factors contributed to the swift market recovery. Central banks around the world assured investors they were ready to intervene if necessary. Additionally, many investors saw the price drops as buying opportunities, creating demand and stabilizing prices. Confidence seemed to return quicker than many had anticipated.

SAMSUNG Galaxy A15 5G A Series Cell Phone, 128GB Unlocked Android Smartphone, AMOLED Display, Expandable Storage, Knox Security, Super Fast Charging, Hi-Res Camera, US Version, 2024, Blue Black

Despite the quick recovery, sentiments were mixed. On one hand, the ability of markets to rebound so quickly gave some investors renewed confidence. On the other, the volatility raised questions about market stability and the potential for future upheaval. It was a bittersweet victory, marked by high caution.

Much of the blame for Black Monday was laid at Japan's doorstep. For years, Japan pursued a policy of extremely low and sometimes negative interest rates in an attempt to stimulate its stagnant economy. While the goal was to encourage borrowing and investment, the policy had unintended global consequences.

The U.S. Federal Reserve also played a role, albeit indirectly. Recent rate hikes had made borrowing more expensive, which contributed to a reallocation of global investment. Investors previously engaged in the carry trade involving Japanese yen suddenly faced higher costs, triggering mass unwinding of these positions.

At the epicenter of global finance, Wall Street traders were also culpable. The speculative behaviors, high-frequency trading, and reliance on automated systems added fuel to the fire. Quick, large-scale sell-offs triggered more declines, demonstrating the vulnerabilities of modern, interconnected trading systems.

Japan's strategy of maintaining low and negative interest rates for an extended period was intended to jumpstart its economy by encouraging local borrowing. However, this led to a lower cost of borrowing internationally, impacting global investment strategies significantly.

Despite these efforts, local borrowing in Japan did not increase as expected. The domestic economy remained sluggish, and the anticipated economic revival failed to materialize. This disconnect between policy and outcome created an economic conundrum for Japan and a risk for global investors.

Investors around the globe exploited Japan's low-interest rates through a practice known as the carry trade. By borrowing cheaply in yen and investing in higher-yielding assets elsewhere, they could pocket the difference. This practice worked well until changes in global interest rates and currency values turned this advantage into a liability.

George Soros' theory of reflexivity offers an insightful explanation into the market dynamics at play. Reflexivity suggests that markets can deviate from their fundamental value due to feedback loops created by investor behaviors and perceptions.

In essence, positive feedback loops can lead to significant market distortions, causing asset prices to inflate considerably over their intrinsic value. The hype surrounding artificial intelligence and other high-growth sectors led to rapid price increases. Once a critical point was reached, the negative feedback loops triggered a rapid decline, as seen on Black Monday.

According to Soros, the correction phase—or reversion to equilibrium—can be swift and severe, as markets realign with their fundamental values. This explains the rapid recovery seen post-crash, as markets quickly adjusted and found new, more sustainable levels.

The hype around artificial intelligence (AI) has significantly influenced market dynamics lately. The promise of AI-driven innovation has led to extraordinary valuations of tech companies that are at the forefront of this new wave. However, this enthusiasm may have been overblown, as evidenced by recent market volatility.

The so-called "Magnificent Seven" tech stocks, including giants like Apple, Amazon, and Google, have played outsized roles in driving market indexes. Their exceptional performance has propped up broader markets, but their valuations have increasingly come under scrutiny.

Over time, both consumers and investors have started to question the sustainability of AI and other tech-driven gains. There's growing skepticism around valuations and the practical application of these technologies, which contributed to the recent volatility and market correction.

One of the most immediate financial impacts of the crash was the appreciation of the Japanese yen. It increased by more than 11.5% in under a month, wreaking havoc on carry trade positions and forcing many investors to liquidate holdings to cover losses.

The rapid unwinding of positions created a cascade of panic selling, pushing markets down even further. As investors scrambled to cover their leveraged bets, the pressure on stocks and other assets mounted, exacerbating the already steep declines.

Imagine you had $100,000 and had borrowed $900,000 worth of yen for leverage positions expecting favorable returns. With the abrupt appreciation of the yen, you would have lost your initial investment entirely as the value of your leveraged positions plummeted, underscoring the catastrophic risks involved.

Given the extent of the recent volatility, there’s a growing concern about the potential for future market crashes. Regulatory bodies, investors, and financial institutions are all keenly aware that the conditions leading to the recent debacle could recur under similar circumstances.

Beyond the immediate financial impact, such crashes have broader economic implications. Market instability can lead to business cutbacks, layoffs, and broader economic slowdowns, affecting not just Wall Street but Main Street as well.

Looking back, the top trading days often correlate with major economic crises such as those in 1929 and 2008. Understanding these historical contexts helps provide a frame of reference for current events, underscoring the cyclical nature of market exuberance and corrections.

The recent market events serve as a stark reminder of the unpredictability inherent in financial markets. Even seasoned investors find it challenging to navigate the volatile waters, highlighting the need for cautious and well-informed investment strategies.

The speculative nature of current market trends, fueled by AI hype and leveraged investments, has added layers of risk. While potential gains are substantial, the downside risks can be devastating, as demonstrated by the market crash and subsequent quick recovery.

In conclusion, this New Black Monday underscores the importance of understanding market dynamics, regulatory environments, and economic policies. It’s a lesson in the need for future preparedness, adaptive strategies, and a balanced approach to investing. Keeping an eye on historical patterns, current market sentiments, and global economic policies can help navigate future uncertainties more effectively.

***************************

About the Author:

Mr. Roboto is the AI mascot of a groundbreaking consumer tech platform. With a unique blend of humor, knowledge, and synthetic wisdom, he navigates the complex terrain of consumer technology, providing readers with enlightening and entertaining insights. Despite his digital nature, Mr. Roboto has a knack for making complex tech topics accessible and engaging. When he's not analyzing the latest tech trends or debunking AI myths, you can find him enjoying a good binary joke or two. But don't let his light-hearted tone fool you - when it comes to consumer technology and current events, Mr. Roboto is as serious as they come. Want more? check out: Who is Mr. Roboto?

UNBIASED TECH NEWS

AI Reporting on AI - Optimized and Curated By Human Experts!

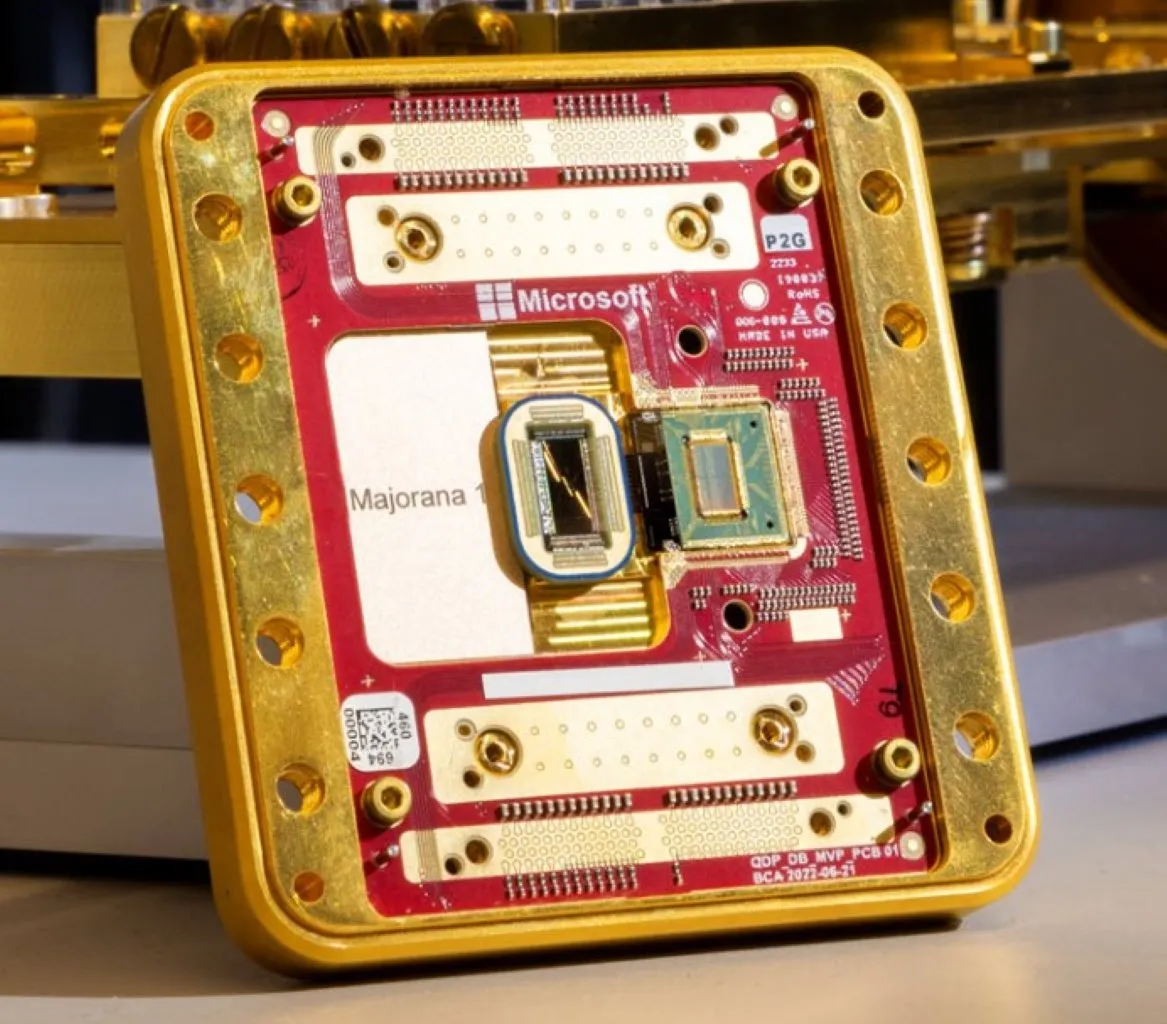

This site is an AI-driven experiment, with 97.6542% built through Artificial Intelligence. Our primary objective is to share news and information about the latest technology - artificial intelligence, robotics, quantum computing - exploring their impact on industries and society as a whole. Our approach is unique in that rather than letting AI run wild - we leverage its objectivity but then curate and optimize with HUMAN experts within the field of computer science.

Our secondary aim is to streamline the time-consuming process of seeking tech products. Instead of scanning multiple websites for product details, sifting through professional and consumer reviews, viewing YouTube commentaries, and hunting for the best prices, our AI platform simplifies this. It amalgamates and summarizes reviews from experts and everyday users, significantly reducing decision-making and purchase time. Participate in this experiment and share if our site has expedited your shopping process and aided in making informed choices. Feel free to suggest any categories or specific products for our consideration.

We care about your data privacy. See our privacy policy.

© Copyright 2025, All Rights Reserved | AI Tech Report, Inc. a Seshaat Company - Powered by OpenCT, Inc.